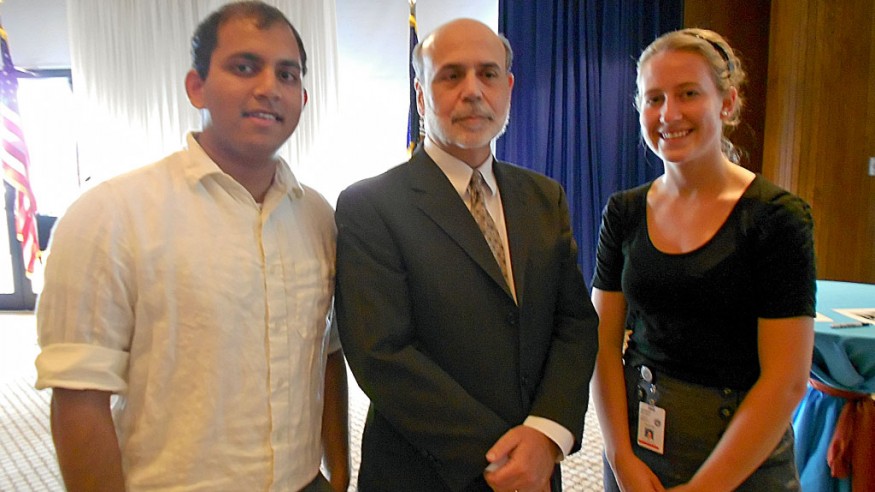

Interning at the ‘Fed’

Pictured here are Adi Manohar ’12; Ben Bernanke, Chair of the Board of Governors; and Shannon Delaney ’12. (Photo courtesy of Shannon Delaney ’12))

When the opportunity arose for two Ohio Wesleyan students to intern at the Board of Governors of the Federal Reserve System this past summer, Adithya (“Adi”) Manohar ’12 and Shannon Delaney ’12 excitedly packed their bags and headed out for the nation’s capital.

“These internships are in the Consumer Affairs research division in Washington, D.C.,” says OWU Professor of Economics, Alice Simon. “Interns are able to work with professional staff as assistants and analysts. Many become coauthors of published research articles, and interns also meet with policy makers and national leaders such as Chairman of the Board of Governors, Ben Bernanke.”

Manohar, an astrophysics and creative writing double major from Bangalore, India, had taken one of Simon’s classes during which he learned about the “Fed.” He accepted her invitation to learn even more by interning there. While a graduate degree program in astrophysics may be in Manohar’s future, he notes, “I now see what a career in economics can be like.”

Delaney, an economics management and Spanish double major from Delaware, Ohio, liked the first-hand experience she gained while learning about economic development matters and the housing crisis.

“It was my first time living on my own,” says Manohar, who found an apartment located about 20 minutes from his office.

“I have to say I’ve learned to make a pretty good chicken curry.” But he also learned—quickly—about statistical analysis he would need on the job while writing codes to analyze data. Manohar read books on statistics and talked with the research assistants in his department. He began recoding data from the Current Population Survey undertaken by the Bureau of Labor Statistics, in preparation for further analyses.

“My analysis focused on the supplement for unbanked and under banked populations in the United States,” he explains. “The big picture involved learning more about the usage patterns of specific alternative financial services such as payday loans, pawn shops, and nonbank money orders by running logistic regressions on what those surveyed stated were reasons for using those services.” Convenience and inability to qualify for a bank account often were cited. Manohar and his colleagues looked at how their responses correlated with such factors as education, race, and income. He was able to generate a written analysis before completing the internship in August.

Delaney, who found housing on the campus of George Washington University, was assigned to work on a mobile banking project, creating a database of past surveys, as she researched historical literature on mobile banking. While attending a Consumer and Community Affairs division meeting, she began working with a senior community affairs analyst looking at the Real Estate Owned (REO) and vacant property situation.

“I became familiar with what had been going on for the past couple of years leading to the huge number of foreclosed homes in the United States,” Delaney says. She also worked with another intern from the Cleveland Federal Reserve on research involving the “Best and Promising Practices of Servicers on the Continuum of REO Maintenance and Disposition,” while also conducting internet research on what mortgage services are doing to help those who are about to lose their homes to foreclosure.

“I saw that there are tenant programs available through Fannie Mae that allow tenants to remain in their homes through a rental agreement,” says Delaney, adding that in too many cases, people just aren’t aware of such opportunities. Part of her research also focused on what banks are doing with [foreclosed] properties in terms of enhancements, repairs, and turning over these properties to community groups.

“I think that practical experiences such as these internships help to define what we do later,” says Manohar. For Delaney, a memorable pert of her time at the Fed was talking with people who are trying to find reasonable and humane solutions to the housing crisis.

“I learned a lot about the current economy and how significant the crisis really is.”